Introduction

About half of the Nigerian population lack access to electricity. According to the World Bank, Nigeria is second place to India in global electricity access ranking. Nigeria also ranks second to Yemen in the Spectator Index of the world’s worst electricity supply in 2017, despite grid power supply peaking at 5,222MW in December 2017.

On the path to improve electricity supply in Nigeria, the Nigerian Electricity Regulatory Commission (NERC) released two regulations: Mini-Grid regulation and Eligible Customers regulation. The MiniGrid regulation aims to promote accessible electricity supply primarily in rural locations, while the Eligible Customers regulation aims to encourage reliable electricity supply through bilateral contracts between Generating Companies (GenCos) and large consumers. Implementing the two regulations are equally important to the progress of Nigeria’s power sector.

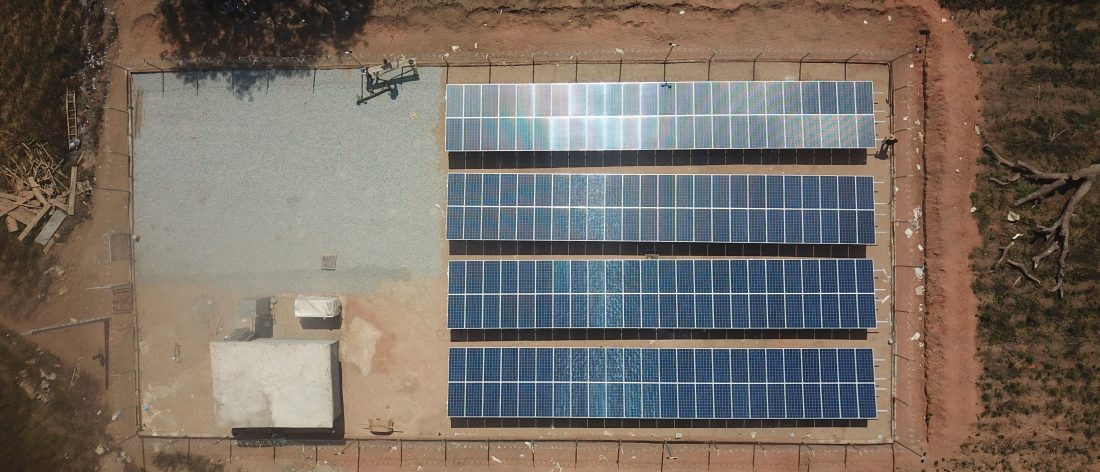

Off-Grid Electricity Supply through Mini-Grids

NERC defines a mini-grid as an integrated local generation and distribution system capable of serving numerous end-users independent of the national grid with installed capacity below 1 megawatt (MW). Mini-grids may be ‘isolated’ (not connected to the main grid) from or ‘interconnected’ with the main grid.

Research has shown that mini-grids are the cheapest way to provide power to at least 100 million of the 600 million people living in Sub-Saharan Africa currently lacking access to power. There have been some success stories in some parts of Africa. For instance, Tanzania has been at the forefront of developing mini-grids with an installed capacity of over 150MW serving over 180,000 customers. This is significant when compared to Tanzania’s grid supply of about 1,500MW.

In Nigeria, the rate of deployment of minigrids has been slow as investors struggle to understand the business case. Currently, installed mini-grid capacity in Nigeria is estimated at about 5MW. Although there are significant economic activities in some off-grid areas, developers have difficulty raising capital because investors are concerned about unclear policies around interconnection and buy-out if the Distribution Companies (DisCos) arrive at these locations. More so, investors are not significantly encouraged by governments, policymakers and even donors who are yet to fully appreciate mini-grids as a viable alternative to the main grid.

Although mini-grids have been proven to be technically feasible in Nigeria, their economic viability as a profitable and

scalable business model is still uncertain. In order to regain the cost of their projects, Mini-grid developers have to charge poor rural customers tariff of about $0.55– $1.00/kWh (N200–N360/kWh), which is more than the average tariff of $0.08 (N28) the DisCos are presently charging gridconnected customers in urban areas. Government support is crucial to reducing the cost of mini-grid supply to enable them compete with alternatives such as diesel generators.

Expanding Electricity Access through Mini-Grids

The Rural Electrification Agency (REA) in championing the growth of the off-grid energy space by providing access to data, access to finance, and acting as intergovernmental, regulatory, and private sector liaison. In 2016, REA initiated eight pilot mini-grid projects with the hope of better understanding the challenges involved in construction, operation and maintenance. The pilot projects also presented an opportunity to better appreciate the social impact and environmental issues that arise in different site locations in the country. To improve access to electricity in rural communities, the World Bank would be providing REA with about $150 million for use in supporting private sector-driven development of 10,000 mini-grids with installed capacity totalling 3,000MW.

For prospective potential investors, minigrids present a great opportunity to participate in the ‘unserved’ and ‘underserved’ electricity market segments. However, if an investor does not have grants or counterpart funding, NERC can consider and approve a cost-reflective tariff for a potential mini-grid project. To this end, NERC has developed a simple tariff calculation tool which enables both developers and customers agree on a project specific tariff path.

To develop a mini-grid sized below 100kW, a prospective developer must register the project with NERC, though

obtaining a permit is optional. For minigrid projects between 100kW and 1MW, the major requirements include obtaining a permit from NERC, confirming from NERC that the mini-grid project in the designated area would not interfere with the approved DisCo’s 5-year expansion plan, obtaining a ‘no objection’ from other developers for that specific location, signing an agreement with the host community, providing evidence of land acquisition or lease and all other necessary permits, and construction.

New Market Opportunity for Supplying Electricity to Eligible Customers

In a major policy directive, the Minister of Power, Works & Housing (MoPWH) declared four categories of eligible customers in the Nigerian Electricity Supply Industry (NESI). Aimed at bringing into play new and stranded generation capacities, the declaration permits eligible customers who previously bought power from DisCos to henceforth procure power directly from GenCos.

The eligible customers declaration presents opportunities for both existing and new generation companies. The declaration further provides that generation capacity added by existing or prospective generation licensees must be at least 20{1c02100822988c48c7b0a484ab61ac3d7f398d67c2f66594d88b2db33072d9d9} above the requirement of the eligible customer, to ensure that short-term demand growths are accommodated. In addition, such generation must be supplied under contract with a distribution or trading licensee at a price not exceeding the average wholesale price being charged to the DisCos by the Nigerian Bulk Electricity Trader (NBET). These requirements will help drive cost efficiency amongst new entrants based on technology, choice of fuel, proximity to customers, etc.

Improving Reliability of Electricity Supply to Eligible Customers

Due to the minimum power consumption requirement of 2MW a month for eligible customers, large industrial customers are poised to benefit the most. In addition to paying for capacity and energy charges to the generators, eligible customers connected at 330kV and 132kV delivery points will also be liable to pay the transmission use of system (TUoS) charge, while those connected at 33kV and 11kV delivery points are to pay the distribution use of system (DUoS) charge.

Eligible Customer declaration signals the dawn of competition in the Nigeria electricity industry and to meet the expected growth in demand, investments would be required in both the transmission and distribution networks. To address the situation where a DisCo will have inadequate revenue because competition that could drive electricity prices down, the MoPWH is empowered by section 28 of the Electric Power Sector Reform Act (EPSRA) 2005 to direct consumers and eligible customers to pay a competition transition charge to DisCos for a certain duration.

Conclusion

Improving Nigeria’s rank in accessibility and reliability of power will be greatly enabled through the mini-grid and eligible customers regulations. Both customers and governments will benefit. With mini-grids, more accessible power supply to off-grid customers has a transformative impact especially in the rural communities. It will improve agricultural output and commercial activities. It will also provide safe light sources for children instead of kerosene lanterns and candles. It would also help government’s efforts to save the environment by reducing the carbon footprint as more trees that could have been used for firewood are saved. With eligible customers, more reliable power supply to industrial customers would allow them to plan their production better, expand, and even employ more people. As industries expand, government benefits from a higher tax revenue from both the increase in industrial output (GDP) and increase in workforce.

Author: Chibueze Ekeh is an industrial engineer and energy finance specialist in oil, gas & power, renewable energy, consulting and financing services.

Editor: Chinazo Ifeanyi-Nwaoha is a power sector analyst focused on the interplay of policy-practice and regulation.