Introduction

The current Business Model in the Nigeria Electricity Supply Industry (NESI) is such that energy is generated by the Generating companies (GenCos) and transmitted to the Distribution companies (DisCos) by the Transmission Company of Nigeria (TCN). The DisCos (identified as utilities in this article) then transfer the energy to the end consumers who pays for what is received. This is a one-way communication system where all end consumers are connected to a centralized grid.

However, there is an existing prediction of a vicious cycle of decline in the utility industry due to decreasing sales from an increasing number of customers adopting Distributed Generation (DG). Industry experts dubbed the phenomenon a “Death Spiral”. Major advancements in electricity generation have aggressively improved efficiency and driven down the cost of these technologies. These bring to mind the fast approaching inception of the Death Spiral.

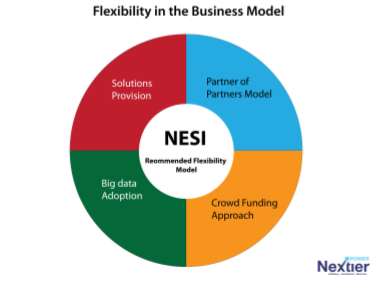

This article focuses on the necessities and possible ways of adopting a flexible business model at the downstream side of the NESI value chain, taking into consideration the predicted Death Spiral.

Need for Flexibility in the Business Model

The current business model in the NESI has been in place since the time of the old Nigeria Electric Power Authority (NEPA). However, with fast changing global technology trends (which is reflected in the increasing numbers of “prosumers”— i.e. customers who consume as well as produce energy) and fast growing disruptive innovations (solar distributed generation, lower cost and mass-scale storage solutions, vibrant and secure micro-grids), it is obvious that the once-clear boundaries of the natural monopoly of electric utilities are becoming blurred and more competitive markets are emerging. Hence, the need for a flexible, resilient and sustainable business model. The recommended flexibility to the existing business model adaptable in the NESI include;

i. Partner of Partners Model – A ‘partner of partners’ utility is a company that offers not only standard power and gas products, but also a range of other energyrelated services. The current service provided to the consumers by utilities is energy provision, however, this service can be enhanced by providing improved energy-related services. These services include energy audit, real time monitoring of energy usage and energy supply monitor. These services will help sustain consumers’ engagement, improve consumers’ insight into consumption patterns and enable consumers to gain more control over energy consumption with respect to energy supply. The additions create a sense of responsibility and ownership for consumers, which in turn, could reduce the frictions experienced between utilities and consumers on their network.

ii. Solutions Provision – On Privatisation, utility providers got assurance of geographical monopolies to ensure investors of business sustainability. However, keeping some of the consumers within the utility providers’ network on the main grid is unprofitable for many considerations such as: their proximity to the main feeder, the service cost to keep them on the grid and their energy demand/usage. Therefore, providing alternative solutions like low energy solar pack with flexible repayment option can prove to be a win-win for these consumers and the utility provider. Additional solutions which the utility providers can consider for their consumers includes behind the meter (BTM) devices and electric charging stations for future consumers. BTM devices are systems uniquely designed for a single building to reduce the amount of electricity bought by the building, to protect the building from the effects of power outage, etc.

iii. Big Data Adoption – The daily operations of utility providers leave a huge chunk of data which has the potential to either be transformed into additional source of income or a massive liability consuming space and time. The data acquired by the utility providers has a huge potential of becoming the most reliable information for behavioural scoring, geospatial analysis and consumers’ segmentation in the country. Therefore, the utilities not only serve as providers of electricity, but also providers of business insights.

iv. Crowd Funding Approach – The biggest and fundamental issues facing the existing business model of the utility providers is the absence of investment funds to revamp the utilities’ networks. This sad reality has translated into poor service delivery which continues to increase consumers’ dissatisfaction. The

utility provider can create a mutual benefit approach for their major consumers (especially the clustered ones) where the consumers can fund its utility provider to refurbish the segment of the network, which will improve their energy supply and quality in exchange for special service and billing. This approach will allow a utility to take advantage of healthier profit margins, and also serve as a strategy to retain its consumer base.

Challenges to the flexible Business Model and Way forward

Utilities Bankability and Existing Tariff

With the existing debt profile of the utilities and the current level of financial exposure incurred by financial institutions from privatisation, it is almost impossible to get any institution (local and international) to invest in the utilities business. This problem is further worsened by the absence of a cost reflective tariff, without which investors will never be assured of a return on their investment.

NEPA ideology

Prior to privatisation, electricity was treated more as a social commodity with an average consumer having a sense of entitlement to energy supply regardless of whether the consumer pay for the energy supplied or not; this is a NEPA ideology. With the inception of a privatised electricity market in the NESI, electricity has completely become an economic commodity. However, the NEPA ideology still holds for a lot of utility consumers, thereby creating a huge revenue shortfall in the NESI.

Collection Efficiency

The current collection efficiency of the utilities is below average of their billing due to energy theft (consumers connected to the grid but do not pay for their energy consumption) and revenue theft (illegal fund collectors operating in utilities franchise – commonly known as NEPA 2 staffs). The existing collection efficiency has so far been a huge setback for the industry’s development.

Way Forward

Crowd funding framework

The existing regulatory frameworks and performance agreements between government and utilities affirms a sole investment responsibility to the utilities.

However, with the huge lack of investment in the NESI, the utilities can benefit from discussing and developing a variety of frameworks with core investors and the regulator which will enable consumers investment in their network.

Lean Operations

Lean operations management focuses on a company’s capability to concentrate solely on those activities that create value for customers, while maximising economic returns subject to mandated restrictions (for the regulated activities) or based on accepted risk levels (unregulated activities). This can be done by process improvements, optimisation of capital expenditure and changes in organisational structure.

Increased customer engagement and enlightenment

It is essential for the utility to identify its customer base (consumers who pay for the energy consumed) and necessary or additional services to ensure they are kept on the grid. The burden falls on the utility to engage with the customers on: what services will be provided? By whom? At what cost? How will providers be compensated and incentivized? How will customers be engaged and incentivized? This will help the utilities build and sustain a healthy relationship with their customers.

Conclusion

Different flexibility approaches have been recommended above, however, it is acknowledged that one size does not fit all and every utility in the NESI has its operational uniqueness. This article serves as a call to utilities to start thinking and acting Innovatively. Utilities need to determine the future direction of their own markets, how these markets are affected by technological advancement and what this means for their business strategies. With fast changing global technology trends and growing disruptive innovations, there is an urgent need for utilities to develop a flexible, resilient, innovative and improved business model – a model for the utility of the future.

Author

Oladiran Adesua is a Business Analyst focused on NESI Performance M&E and regulatory consulting.

Editor

Chinazo Ifeanyi-Nwaoha is a power sector analyst focused on the interplay of policy-practice and regulation.